February 8, 2012 by John Myers

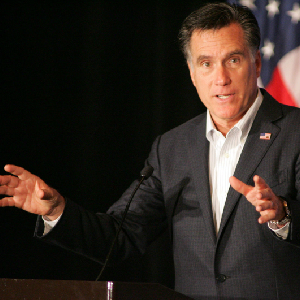

UPIMitt Romney is a venture capitalist.

UPIMitt Romney is a venture capitalist.“Greed, for lack of a better word, is good. Greed is right, greed works.” — Gordon Gekko, “Wall Street”

“Like Gekko, Romney made his fortune buying and selling companies.” — Salon.com, Jan. 9

Republican Presidential candidate Mitt Romney has accumulated a vast amount of wealth and in doing so probably hasn’t broken a law or bylaw. However, Romney isn’t being honest about what kind of business he operated and he greatly exaggerates his business know-how.

Romney made that money not by building things but by tearing things down. His wealth was created through takeovers, buyouts and mergers. So his claim that he knows how to renew the American dream is disingenuous at best.

Vulture Economics

Romney founded Bain Capital in 1984 and oversaw the operations of the firm for several years. That put him in charge of business takeover operations similar to what the fictional Gordon Gekko ran ruthlessly in Oliver Stone’s movie “Wall Street.”

Private equity firms like Bain shift capital around. They prey on companies that they take over. Sometimes, they burden them with huge debts. Sometimes, they leave them with zero real assets. Many of the companies go bankrupt while the private equity firms pad their balance sheets.

Private equity firms buy companies they plan to bankrupt. They don’t care about how many pink slips are handed out. Their goal is to make sure that creditors collect as little as possible. To accomplish their goal, they transfer the assets of the acquired companies into other companies. That means big profits for private equity firms, but the economy gains nothing.

There is nothing illegal in it (unless, like Gekko, you use insider trading to fatten your profits), but it doesn’t add jobs. If anything, Romney is in the business of slashing jobs to get a bigger bottom line.

Romney Is No Henry Ford

Romney uses his resume to proclaim that he knows how to energize the American economy. Buying companies and trading stocks and bonds doesn’t so much as put a shingle on a barn.

Romney argues that he was helping workers and investors. Ron Paul disagrees. According to Paul, under the terms of a typical leveraged buyout, “The wealth is taken from the middle class and it goes to the select few, who are the insiders.”

Former GOP Presidential candidate and Texas Governor Rick Perry agrees with Paul.

“I happen to think that companies like Bain Capital could have come in and helped these companies if they truly were venture capitalists,” Perry told voters in Lexington, S.C. “But they’re not — they’re vulture capitalists.”

Romney doesn’t help himself. Not only does he wear expensive suits like Gekko, but he seems to have some of the same attitudes. In “Wall Street,” Gekko says, “If you need a friend, get a dog.”

Romney expressed pretty much the same view when he said: “I like being able to fire people.” Like Gekko, Romney could have added: “Lunch is for wimps.”

On Jan. 19, Sun Sentinel.com ran a column by Bill Press that argued against Romney’s public relations blitz regarding his business expertise.

There’s a big difference between the attacks on John Kerry’s war record in 2004 and the questions raised about Mitt Romney’s business record in 2012. The entire Swift Boat campaign was nothing but one big fat lie. But Gingrich and Perry are only telling the truth. Corporate predators like Bain Capital do, in fact, swoop in on distressed companies, leverage them with debt, strip them down, fire workers or export jobs, and then sell companies off for scrap — while investors walk away with huge profits.

Citing the success of Domino’s, Sports Authority and Staples, Romney brags about creating a “net 100,000 new jobs.” But he’s offered no proof of that claim, and his numbers don’t add enough. The 100,000 figure includes current employers of all three companies, hired long after Bain left the scene. And it doesn’t factor in the thousands of jobs Romney/Bain destroyed by looting other companies. Indeed, out of 77 companies taken over by Bain, the Wall Street Journal found that 22 percent had either filed for bankruptcy or simply shut their doors. The truth is, Romney was never a job creator. He was a wealth creator. And it’s a lie for him to suggest otherwise.

Just as it’s a lie to suggest that he ever lived in fear of getting a “pink slip.” As reported by the Boston Globe, Romney had a deal with Bain Capital that allowed him to return to his former job at his former salary if things didn’t work out. For him, there was zero financial risk.

There is also the contradiction between Romney the venture capitalist and Romney the political leader. As the Governor of Massachusetts, his reduction of the State bureaucracy was modest, as Boston Globe reporters Scott Helman and Michael Kranish report in their book, The Real Romney: “After four years, he reduced the payroll of agencies under his direct control by 603 jobs, according to his administration’s tally.”

Helman and Kranish point out that Romney’s predecessor, Republican Governor William F. Weld “had closed state hospitals, privatized services, and slashed about 7,700 jobs during his first term, though the numbers had later increased when the economy improved.”

The Men That Built America

As for Romney, the businessman, some of you may believe that plundering is straightforward economic Darwinism — a necessary and, ultimately, good thing. If that is true, then Bain Capital not only survived but thrived under Romney’s leadership.

What is not true is that Romney has business experience that builds up corporations and creates a vast number of jobs. Perhaps that is not his fault. He might have been born a century too late.

I came across a list of the richest individuals in history. Nobody alive is on that list. Men like Bill Gates and Warren Buffet are not even in the same ballpark as that crowd. The Americans who are on the list are the magnates of industry who were building their fortunes and the Nation in the early 1900s.

John D. Rockefeller is noted as the richest individual ever. His personal fortune peaked at $318.3 billion in 2007 U.S. dollars.

The second richest ever — Andrew Carnegie — had his personal wealth top out at $298.3 billion, again adjusted for inflation.

Others in the top 10 list include William Henry Vanderbilt, Andrew William Mellon and Henry Ford. They were the builders. The others in the list were plunderers, including: Marcus Licinius Crassus at No. 8 with $170 billion; and Nicholas II, the last tsar of Russia, at No. 3 with $253.5 billion.

What America so desperately needs today are leaders and builders like Carnegie and Ford, not pillagers like Crassus and Nicholas. What disturbs me most about Romney in his campaign for the Presidency is that his business model more closely resembles the latter than it does the former.

Yours in good times and bad,

Interesting perspective.

No comments:

Post a Comment